The intersection of politics and economics is always complex, usually polarizing, and at times distressing to navigate. Every 4 years, these qualities reach peak intensity as citizens are submerged in the democratic spectacle of choosing their next commander in chief. As candidates vie for the highest office in the land, the financial markets watch with bated breath, anticipating the potential impacts of a change in leadership. Over the decades, a prevailing notion has emerged that presidential elections exert a significant influence on the stock market, with outcomes triggering shifts in investor sentiment and market performance. To this point, Nationwide’s 9th annual Advisory Authority survey found that 45% of investors believe the results of the 2024 US Federal Elections will have a bigger impact on their retirement plans and portfolios than the performance of the US stock markets1. That is 45% of people polled, regardless of political affiliation. This article delves into the historical relationship between US presidential elections and the stock market, exploring the patterns, myths, and realities that have shaped this complex interaction.

The Historical Context:

To understand the impact of presidential elections on the stock market, it is crucial to consider the broader historical context. The United States has witnessed 59 presidential elections since its inception, each occurring against the backdrop of unique economic, social, and geopolitical circumstances. From the early years of the republic to the modern era of globalization, presidential elections have reflected and influenced the nation’s economic trajectory.

One of the key factors influencing the stock market during presidential elections is uncertainty. Elections introduce a degree of uncertainty regarding future policy direction, regulatory frameworks, and economic priorities. Investors often grapple with questions about how the incoming administration’s policies will affect corporate profits, taxation, trade relations, and overall market stability. This uncertainty can lead to volatility in the stock market as investors adjust their portfolios in response to evolving political dynamics.

Patterns and Trends:

Despite the prevailing belief in the influence of presidential elections on the stock market, empirical evidence suggests that the relationship is more nuanced than commonly perceived. Historical data reveals a variety of patterns and trends, with outcomes influenced by factors such as economic conditions, geopolitical events, and the candidates’ policy platforms.

One commonly cited trend is the “presidential election cycle theory,” which posits that stock market performance follows a predictable pattern based on the four-year presidential election cycle. According to this theory, the first two years of a president’s term typically witness below-average stock market returns as the administration implements potentially unpopular policies. In contrast, the latter half of the term, particularly the third year, tends to experience above-average returns as the president seeks to boost economic prospects ahead of reelection. However, research has shown that while this pattern may hold true in some instances, it is far from a reliable predictor of stock market behavior during presidential election cycles.

Moreover, historical data indicates that the stock market’s reaction to presidential elections can vary widely depending on the prevailing economic conditions and external factors. For example, elections held during periods of economic uncertainty or crisis may elicit more pronounced market reactions as investors seek clarity on future policy direction. Conversely, during periods of economic stability and growth, the market may exhibit more subdued responses to electoral outcomes.

Case Studies:

Examining specific presidential elections can provide valuable insights into the relationship between electoral outcomes and stock market performance. One notable example is the 2016 election, which saw Donald Trump elected against the majority of opinion polls and election forecasts. In the immediate aftermath of the election, US stock futures initially plummeted as uncertainty shrouded the market amid concerns about Trump’s unconventional policy proposals and rhetoric on trade and immigration. However, within days, the market staged a remarkable recovery, fueled by optimism over the prospects of pro-business policies such as tax cuts and deregulation. Ultimately, the S&P 500 index reached record highs during Trump’s presidency, underscoring the complexity of the relationship between presidential elections and stock market performance.

Contrastingly, the 2008 election occurred amidst the backdrop of the global financial crisis, marking one of the most tumultuous periods in recent memory. As Barack Obama secured victory amid widespread economic turmoil, the stock market experienced significant volatility, reflecting investor apprehensions about the incoming administration’s ability to navigate the crisis. However, in the years that followed, the market staged a remarkable recovery, buoyed by unprecedented stimulus measures and efforts to stabilize the financial system.

Myths and Realities:

Amidst the speculation and conjecture surrounding the impact of presidential elections on the stock market, several myths and misconceptions have emerged. One common myth is the notion that stock market performance during an election year is a reliable predictor of the election outcome. While some analysts may attempt to draw correlations between market trends and electoral prospects, empirical evidence suggests that such predictions are unreliable. The stock market is influenced by a myriad of factors beyond politics, including economic data, corporate earnings, and global events, making it inherently unpredictable as a barometer of electoral outcomes.

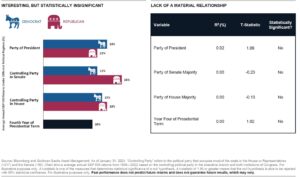

Another prevalent myth is the belief that a particular political party’s victory is inherently bullish or bearish for the stock market. While certain policies or agendas may align more closely with investor preferences, the market’s reaction to electoral outcomes is highly contingent on a multitude of factors, including the specifics of the winning candidate’s agenda, prevailing economic conditions, and broader market dynamics. History has shown that both Republican and Democratic administrations have presided over periods of market growth and decline, underscoring the complexity of the relationship between politics and the stock market. Data collected by Bloomberg and Goldman Sachs Asset Management shows that the historic average S&P 500 annual returns under a Democrat or Republican president have a statistically insignificant number of overall gains with 13% and 15% increases respectively.

Conclusion:

While conventional wisdom suggests a strong correlation between electoral outcomes and market performance, empirical evidence reveals a more nuanced and complex relationship. Although elections introduce uncertainty that can influence investor sentiment and market dynamics, the ultimate impact on the stock market is shaped by a myriad of factors, including economic conditions, geopolitical events, and the specifics of the winning candidate’s agenda.

As investors navigate the uncertainties of presidential elections, it is imperative to approach market analysis with a nuanced understanding of the interplay between politics and economics. While electoral outcomes may trigger short-term volatility, the long-term trajectory of the stock market is driven by a broader array of factors, including innovation, productivity, and global economic trends. By maintaining a diversified portfolio and a disciplined investment strategy, investors can navigate the ebbs and flows of the political landscape while pursuing their long-term financial goals.

It is generally posited that that stock markets are more volatile in times of uncertainty. The months preceding a US presidential election can be some of the most uncertain times Americans face every four years as the country wonders which ideology will come out on top. With the voting populous divided remarkably evenly between the two main political parties and political polls becoming more unreliable, there is little hope that this trend of uncertainty leading up to presidential elections will wane any time soon. This uncertainty coupled with the diverging directions the Democrats and Republicans see as the optimal path forward for the country will most likely cause some market volatility over the coming months. But if history is to be repeated, once the uncertain outcome becomes a certain result, regardless of which party births the successful candidate, the markets will find their footing and march forward. The US stock market has been a resilient marketplace for more than 230 years with far more good years than bad regardless of who is sitting in the Oval Office.

While each of us may have very deep feelings and care a lot about which party wins the White House, it would appear that the US stock markets just don’t.

As a profession, Financial Planners help clients see past the rhetoric and blustering of the political campaigns. We aim to help our clients forge through the wilds of political cycles and into a financial security that extends far beyond the uncertain outcome of our next President.

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Adviser.

- https://news.nationwide.com/101123-nearly-half-of-investors-believe-2024-election-will-have-a-big-impact-on-portfolios/?utm_source=prn